More Foreclosures Mean Lost Opportunities for Homeowners, Realtors

11/13/2014 12:40 PM (CST)

More than five years after the foreclosure crisis began, the number of borrowers losing their homes is rising again. Most of the troubled loans are not new; instead, the backlog of homes in the foreclosure process is finally starting to move more quickly, according to Yahoo Finance.

Foreclosure filings, which include default notices, scheduled auctions and bank repossessions, were reported on 123,109 properties in October, according to RealtyTrac, a foreclosure sales and data company. That is a 15 percent increase from September, and the largest monthly increase since the peak of the crisis in March of 2010.

The numbers are still down 8 percent from a year ago. Foreclosure activity usually spikes in the months before the holiday season, as banks want to get as many done before implementing holiday moratoria. Over the past three years there has been an average 8 percent monthly uptick in foreclosure auctions in October.

Mortgage volume stalls with rates, “But the sheer magnitude of the increase this year demonstrates there is more than just a seasonal pattern at work,” said RealtyTrac vice president Daren Blomquist. "Distressed properties that have been in a holding pattern for years are finally being cleared for landing at the foreclosure auction."

Since the crisis began, there has been a distinct difference in foreclosure volumes between states that require a judge in the process and those that do not. Now the difference is fading. Foreclosure auctions in judicial states rose 21 percent month-to-month, while those in non-judicial states rose 27 percent.

"There is still strong demand from the large institutional investors at the foreclosure auction in some markets, but even in markets with decreasing demand at the foreclosure auction, banks can be confident in selling REO [repossessed] properties quickly and at a good price," Blomquist added.

"That's because there is still strong demand from buyers, particularly in the lower price ranges, combined with a dearth of distressed homes listed for sale."

Strong buyer demand at foreclosure auctions has helped stem the number of properties being repossessed by banks. October, again, was an anomaly, with lenders taking ownership of nearly 28 thousand properties, up 22 percent from September. Still, repossessions were down 26 percent from a year ago.

What does this suggest to real estate professionals? Mostly, lost opportunities to help homeowners avoid foreclosure, complete a short sale, and collect commission. On the bright side, the fact that banks are ramping up foreclosure efforts suggests that there will be opportunities in the future, but you must start contacting your leads now and start the short sale process as soon as possible.

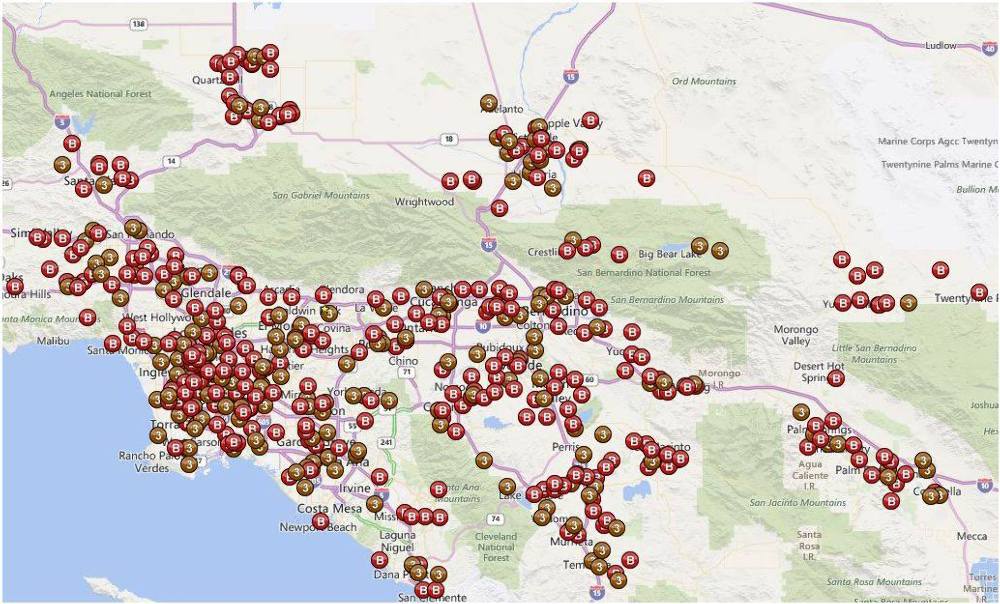

And here's a message to those real estate professionals who believe short sales are over: 1) increasing number of foreclosures suggest otherwise; 2) Take a look at the map in the picture provided alongside this post (as per Diana Ortiz): 1200+ homes were sold at public auction (foreclosure) in the past 30 days in these 4 counties (California). Everyone of these dots could've been your listing...