Is 600 New 700? Not so Fast!

02/18/2014 10:02 AM (CST)

Is a credit score of 600 a new 700? No, and it will never be. However, banks are sending a message that there is some hope for buyers with dinged credit. The Wall Street Journal reports that Franklin Codel, a top mortgage executive at the bank, talked about the lower limits for loans backed by the Federal Housing Administration at a conference last week.

Is a credit score of 600 a new 700? No, and it will never be. However, banks are sending a message that there is some hope for buyers with dinged credit. The Wall Street Journal reports that Franklin Codel, a top mortgage executive at the bank, talked about the lower limits for loans backed by the Federal Housing Administration at a conference last week.

This week, there has been more rumors that Wells Fargo is expected to offer loans to prospective homeowners with scores as low as 600.

The previous limit was 640.

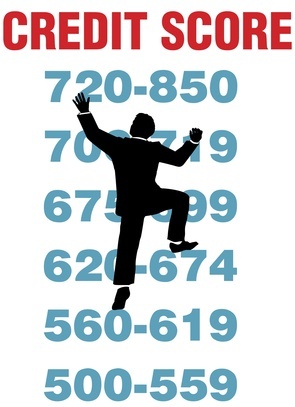

According to MyFico.com, a credit score of 600 is considered to be “poor.”

- Excellent (750+)

- Good (700 - 749)

- Fair (650 - 699)

- Poor (600 - 649)

- Bad (below 599)

As it is widely known, lenders pulled back on giving mortgages to borrowers with less-than-perfect credit in 2008 as the number of borrowers who foreclosed on their homes spiked. That’s left millions of would-be home buyers shut out of the housing market. This vicious circle has created the market where the only buyers capable of purchasing real estate are cash investors.

Revisions made over the summer to Federal Housing Administration guidelines and technical updates in November to Fannie Mae loan approval systems have opened the door for some former homeowners to buy again just one year after foreclosure.

Under the Federal Housing Administration’s “Back to Work” program, it will approve certain borrowers for a home loan just one year after a foreclosure, short sale, deed in lieu of foreclosure or bankruptcy.

FHA’s previous timeline was three years for a short sale and foreclosure and two years for a bankruptcy.

Federal mortgage backer Fannie Mae has previously allowed homebuyers who completed a short sale to buy again after two years if they put 10 percent down, but an automatic underwriting system couldn’t differentiate a short sale from a foreclosure and would spit out a denial.

On the other hand, until we see realistic numbers on new loans clearly showing that the lenders are lowering the bar, it would be unfair to send borrowers a definite message of any meaningful shift in policies. So far, the bar to getting a mortgage remains high.

Applicants who were denied a mortgage in September, 2013, had an average FICO score of 696, according to Ellie Mae—a score that’s relatively stellar by most counts. Before the recession it was common for borrowers with credit scores in the 600 range and below to get mortgages.