Identity Theft: Now Every 2 Seconds

07/02/2014 12:20 PM (CST)

When picturing dangerous criminals, most of us still think of a gun wielding guy in a ski mask or a powerful international drug cartel doing their dirty deals in a dimly lit backroom. The reality, however, is very different.

When picturing dangerous criminals, most of us still think of a gun wielding guy in a ski mask or a powerful international drug cartel doing their dirty deals in a dimly lit backroom. The reality, however, is very different.

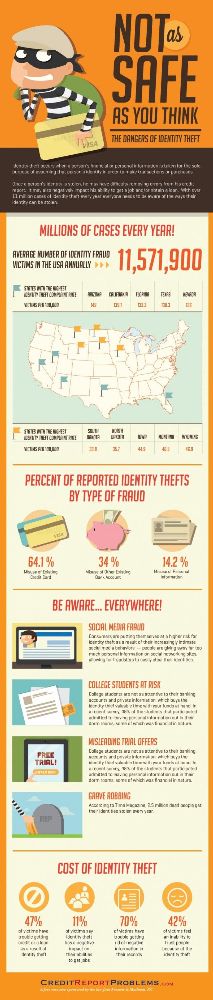

According to the Federal Trade Commission, identity theft is the number one consumer complaint, accounting for 14 percent of all complaints recorded by the government in 2013. There were 10 million more instances of identity theft than all other nonfatal violent crimes combined!

Every 2 seconds, an identity is stolen.

The big data breaches almost seem routine. The count is 368 breaches so far this year, according to the Identity Theft Resource Center, a cybercrime research and education group. That's up nearly 19 percent from the same period last year. The number of personal records exposed in 2014 thus far? Over 10 million.

According to the same report, released in December 2013, over 34.2 million adults, or 14 percent of Americans 16 or older, had experienced some form of identity theft in the past.

Identity theft -- when someone uses such personal data to do anything from fraudulently opening a new bank account to fooling the police -- is a crime on the rise in prominence, and in recent years, prevalence.

Where does identity theft happen the most? Everywhere across the country.

Florida topped the list of per capita identity theft complaints that year, followed by Georgia, California, Michigan and Nevada.

According to FTC, the following measure can help prevent identity theft.

- Lock your financial documents and records in a safe place at home, and lock your wallet or pursein a safe place at work. Keep your information secure from roommates or workers who come into your home.

- Limit what you carry. When you go out, take only the identification, credit, and debit cards you need. Leave your Social Security card at home. Make a copy of your Medicare card and black out all but the last four digits on the copy. Carry the copy with you — unless you are going to use your card at the doctor’s office.

- Before you share information at your workplace, a business, your child's school, or a doctor's office, ask why they need it, how they will safeguard it, and the consequences of not sharing.

- Shred receipts, credit offers, credit applications, insurance forms, physician statements, checks, bank statements, expired charge cards, and similar documents when you don’t need them any longer.

- Destroy the labels on prescription bottles before you throw them out. Don’t share your health plan information with anyone who offers free health services or products.

- Take outgoing mail to post office collection boxes or the post office. Promptly remove mail that arrives in your mailbox. If you won’t be home for several days, request a vacation hold on your mail.

- When you order new checks, don’t have them mailed to your home, unless you have a secure mailbox with a lock.