HELOCs: The Next Ticking Bomb?

08/14/2014 04:00 PM (CST)

A HELOC nightmare might be what’s next in store for the still healing real estate market. A recently released study by TransUnion Corp. reported that approximately $50 billion to $79 billion in outstanding Home Equity Lines of Credit (HELOC) balances reported at the end of 2013 could be at a high risk of default in the next three years.

A HELOC nightmare might be what’s next in store for the still healing real estate market. A recently released study by TransUnion Corp. reported that approximately $50 billion to $79 billion in outstanding Home Equity Lines of Credit (HELOC) balances reported at the end of 2013 could be at a high risk of default in the next three years.

As reported by DSNEWS, 16 million consumers in the U.S. accounted for a total of about $474 billion in HELOC balances as of December 2013. About 92 percent of those balances ($438 billion) had yet to reach their end of draw (EOD) period – the point at which consumers must start repaying their balances with fully amortized payments and cannot borrow funds from their lines of credit any longer.

The addition of principal causes payments to become even higher for the borrower; according to TransUnion, 95 percent of HELOC balances at the end of 2013 were higher than $20,000. More than half of all HELOC balances (52 percent) exceeded $100,000, the study reported.

"Home equity lines of credit were quite popular during the housing boom in the mid-2000's," said Steve Chaouki, head of financial services at TransUnion. "For many people, HELOCs represented a low-interest rate opportunity to borrow against the value of their homes, which were rapidly appreciating at the time. HELOCs generally had lower interest rates than credit cards or other loan types, and that interest was often tax-deductible."

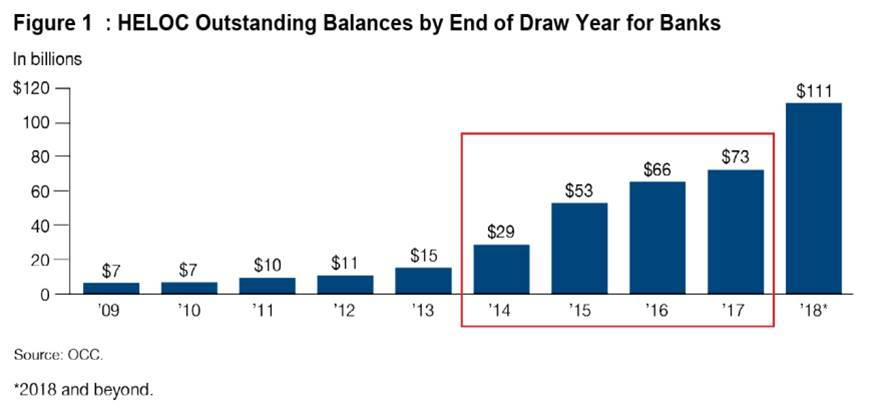

The TransUnion study reported that almost half of the balances at the end of 2013 originated with HELOCs established between 2005 and 2007 with a 10-year draw period, which means those HELOCs will reach their end of draw period between 2015 and 2017 – and some will not be able to handle the increased payment.

"The financial shock associated with a HELOC payment increasing to cover both – principal and interest – can cause liquidity issues for some borrowers; this dynamic is driving significant concern in the lending marketplace," said Chaouki. "Our study indicates that up to $79 billion of those HELOC balances could be at elevated risk of default in the next few years. Though significant in dollar terms, the study isolated the risk to fewer than 20 percent of balances."

Here’s an example of how HELOW borrowers could feel a payment shock.

Consumer A takes out an $80,000 HELOC at a 7% annual percentage rate (APR) with a 10-year draw period in the mid-2000’s.

Monthly payment is $467 during first 10 years of loan (can use money from that HELOC to make payments). At EOD (End of Draw) period, payment jumps by more than half to $716 as the consumer must now pay both interest and principal of the loan (borrower also cannot use funds from the original HELOC to help pay down the monthly balance).

The report said that the traditional credit score was the most effective metric used to determine which consumers were at a high risk for default on their HELOC balances when they reached their EOD period. Those with low credit scores and high debt-to-income ratios were more likely to default. When determining which consumers were at a higher risk to default, the study also took into account several metrics to measure how likely a consumer could take the shock of having to pay both principal and interest.

The study reported that through comparing HELOC balances with home values that there was a way to pay off a HELOC without defaulting for those consumers who had sufficient equity built up in their homes. The equity would allow those homeowners more options, namely to refinance the line of credit or sell altogether.