Fannie Mae’s Significant Derogatory Events and Waiting Periods

08/21/2014 06:32 PM (CST)

There has been some confusion among consumers and real estate professionals alike in regards to the updated Fannie Mae rules. So we decided to go directly to the source and do a quick overview of what the new rules entail and how they are going to affect your business.

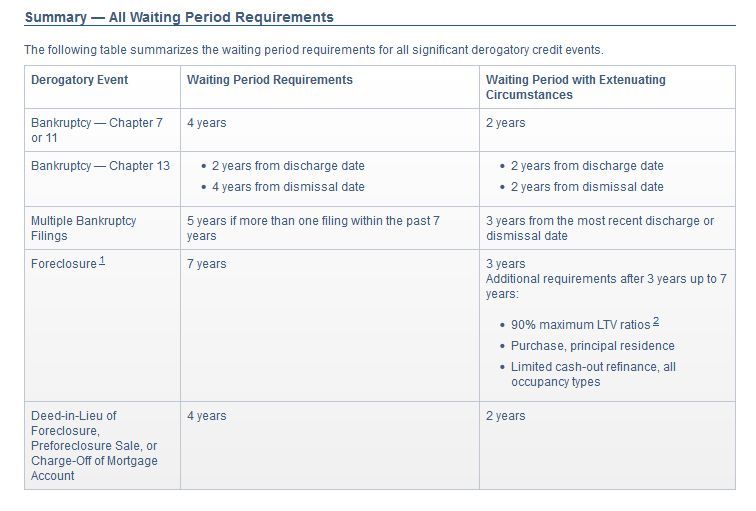

A document B3-5.3-07, made public on the Fannie Mae website on July 29th and called “Significant Derogatory Credit Events – Waiting Periods and Re-establishing Credit” lays out new rules and specifies waiting periods for consumers who have went through a foreclosure, bankruptcy, short sale and/or have charge-offs of mortgage accounts.

The presence of significant derogatory credit events dramatically increases the likelihood of a future default and represents a significantly higher level of default risk. Examples of significant derogatory credit events include bankruptcies, foreclosures, deeds-in-lieu of foreclosure, preforeclosure sales, short sales, and charge-offs of mortgage accounts.

The lender must determine the cause and significance of the derogatory information, verify that sufficient time has elapsed since the date of the last derogatory information, and confirm that the borrower has re-established an acceptable credit history. The lender must make the final decision about the acceptability of a borrower’s credit history when significant derogatory credit information exists.

This topic describes the amount of time that must elapse (the “waiting period”) after a significant derogatory credit event before the borrower is eligible for a new loan salable to Fannie Mae. The waiting period commences on the completion, discharge, or dismissal date (as applicable) of the derogatory credit event and ends on the disbursement date of the new loan for manually underwritten loans.

Fannie Mae requires that lenders review the credit report and Section VIII, Declarations, of the loan application to identify instances of significant derogatory credit events. Lenders must review the public records section of the credit report and all tradelines, including mortgage accounts (first liens, second liens, home improvement loans, HELOCs, and manufactured home loans), to identify previous foreclosures, deeds-in-lieu, preforeclosure sales, charge-offs of mortgage accounts, and bankruptcies. Lenders must carefully review the current status of each tradeline, manner of payment codes, and remarks to identify these types of significant derogatory credit events. Remarks Codes are descriptive text or codes that appear on a tradeline, such as “Foreclosure,” “Forfeit deed-in-lieu of foreclosure,” and “Settled for less than full balance.”

Significant derogatory credit events may not be accurately reported or consistently reported in the same manner by all creditors or credit reporting agencies. If not clearly identified in the credit report, the lender must obtain copies of appropriate documentation. The documentation must establish the completion date of a previous foreclosure, deed-in-lieu or preforeclosure sale, or date of the charge-off of a mortgage account; confirm the bankruptcy discharge or dismissal date; and identify debts that were not satisfied by the bankruptcy. Debts that were not satisfied by a bankruptcy must be paid off or have an acceptable, established repayment schedule.

Waiting or no waiting, boomerang buyers are back. According to John Burns Real Estate Consulting (JBREC), boomerang buyers who lost a home to a foreclosure or short sale between 2007 and 2013 are projected to make about 10 percent of all U.S. home purchases in 2014.

How quickly someone can bounce back from a foreclosure or a short sale depends on the reasons for the past financial problems and on the person’s current credit score. A would-be borrower who had good credit history before a job loss, for instance, is more likely to qualify for a new mortgage than one who had bad credit and continues to demonstrate poor financial habits.